There is no denying that 2023 has been a turbulent year for the US fashion market, as declining consumer confidence continued to take hold of the region and impact wider sales. No matter, while some large-scale conglomerates attempted to build up their defences through turnaround strategies, there were some positives for the industry, namely in eye-watering valuations and forward-thinking legislation. FashionUnited has rounded up some of the top news of the year.

Bed Bath & Beyond succumbs to bankruptcy

2023 already began with a rocky start when it became clear that cosmetics and personal care giant Bed Bath & Beyond was on the path to bankruptcy. Speculation surrounding the impending Chapter 11 started mounting following the publication of the company’s financial statement for Q3 2022, in which it was revealed that net sales had taken a 33 percent hit, with a decrease in customer traffic cited as one of the causes.

While stating that it would be taking steps to improve cash position, Bed Bath & Beyond still noted that there was “substantial doubt” about its ability to continue and three months later finally announced it had succumbed to bankruptcy. Embarking on a process to wind down the business, its 360 stores remained open until their scheduled closure around August. Prior to this, however, furniture platform Overstock announced its intention to rescue the company’s intellectual property in a 21.5 million dollar deal, allowing its e-commerce site to remain operational.

Kohl’s faces a boardroom battle

Last year, department store chain Kohl’s became the centre of a boardroom upheaval battle when activist shareholders Ancora Holdings and Macellum Advisors launched campaigns calling for a board refresh amid financial “underperformance”. The conflict continued well into 2023 and resulted in a number shifts among the company’s executive team, including the appointment of a new CEO, Tom Kingsbury, who joined Kohl’s at a time when it had entered into a cooperation agreement with Macellum.

Following his appointment, Kingsbury requested patience from shareholders as Kohl’s embarked on its transitional year ahead, a call he made after a steep 23 percent decline in gross margins was reported in the company’s Q4 2022 report. One initiative Kohl’s has been leaning into is its ongoing partnership with beauty retailer Sephora, which was expanded this year to now be housed in 850 collaborative stores across the US.

Supreme’s creative director details ‘systemic racism’

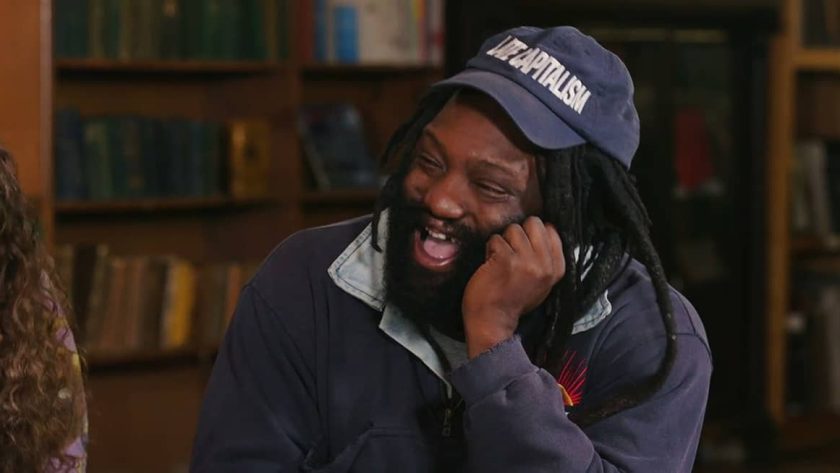

New York-based Supreme became another in the long list of fashion labels to come under scrutiny regarding diversity-focused malpractices. This became evident when its former creative director, Tremaine Emory, stepped down after just over a year at the streetwear brand, later citing his reason to be evidence of “systemic racism”. In his letter of resignation, acquired by Business of Fashion, Emory claimed that racism had been built into the structure of Supreme, an issue that was highlighted after a planned collaboration with artist Arthur Jaffa had been cancelled without “full visibility for the reasons behind it”.

In a response, Supreme said that it “strongly” disagreed with Emory’s characterisation of the company and noted that Jaffa’s project had not in fact been cancelled. It continued: “This was the first time in 30 years where the company brought in a creative director. We are disappointed it did not work out with Tremaine and wish him the best of luck going forward.”

Gap has a company overhaul

Gap was facing its own issues this year in the aftermath of its calamitous former relationship with rapper Kanye West, which had broken down towards the end of 2022. Its later challenges were characterised by lacklustre financials for FY22, during which it had accumulated a net loss of 202 million dollars and declining sales at all of its portfolio brands. As a result, the group said it was to take actions to further simplify and optimise its structure in a bid to secure 300 million dollars in annual savings.

Its first step, outlined in April, was to axe around 1,800 jobs within its upper field and headquarters workforce in a bid to realise such savings during the year. It also made a number of changes to its executive leadership team, namely that of the appointment of former Mattel president Richard Dickson as CEO, who was brought on to help redefine the future potential of Gap.

Music tours and fandoms boost local economies

It wasn’t all doom and gloom in the US, however. 2023 could also be defined by the rise of dedicated ‘fandoms’, who had an undoubtedly large impact on the national, and international, economy. In North America, this was led by large-scale music tours, namely by the likes of Beyoncé, Taylor Swift and Harry Styles, who took to stadiums across the country keeping a steady stream of fans flowing into city centres. According to various reports, for example, both Swift’s Eras Tour and Beyoncé’s Renaissance Tour may have bolstered the US economy by a combined nine billion dollars, feeding into local businesses, hospitality venues and fashion brands that dressed the thousands of attendees at each show.

Not only that, but it would be hard to speak on culture’s impact on fashion this year without highlighting the summer’s ‘Barbenheimer’ movement. While the combination of Oppenheimer and Barbie caused a stir in the realm of cinema, the latter’s release also sparked a new wave of Barbie-centric fashion trends and an influx of hot pink collaborations and collections onto the scene.

Impact of Hollywood strikes leaks into industry

Hollywood continued to have an impact on the fashion industry throughout the year in light of the SAG-AFTRA strikes that took over the world of entertainment for the majority of this period. Starting in July and ultimately ending in the beginning of November, Hollywood’s strike not only brought into question the status of red carpet events, it also fed into the rising friction among fashion professionals who are similarly seeking protection within the escalating adoption of artificial intelligence (AI).

In a statement to FashionUnited, New York-based fashion attorney, former model and SAG-AFTRA member, Kaitlin Puccio, said that brands and models were already negotiating over how to use AI to replicate a model’s likeness, for which the industry has not yet adopted clear rules. She added: “Models don’t have a union in the US to make these decisions for them. The strike by SAG-AFTRA will bring this issue to the top of mind for models.”

California and New York outline accountability legislations

Accountability was also a running theme throughout the year, too. In both New York and California legislations and state bills looked to tackle issues in the areas of sustainability and supply chain management. The Fashion Act, for example, would hold retailers operating in New York to hold fashion brands accountable for their environmental and social impacts, enforcing them to disclose certain information on their supply chains and amend poor practices.

Meanwhile, in California, the Garment Worker Protection Act, signed into law last year, has attempted to ensure the protection of minimum wage in the region and will hold companies responsible for wage theft violations at state-based factories. Similarly in California, lawmakers proposed the Climate Corporate Data Accountability Act which, similar to New York’s, would require corporations to annually and publicly report their greenhouse gas emissions. The bill garnered support from trade organisations, such as the CFDA and AAFA, each of which had also established the Threads Protocol in January to assist policymakers in ensuring the advancement of sustainable solutions.

Trade organisations tackle supply chain issues

Challenges within the supply chain were also evident on an international level, ultimately impacting the operations of US businesses. The most notable of such setbacks came when garment workers in Bangladesh erupted in escalating protests triggered by increased demand for a fairer living wage. After weeks of violence that led to two deaths, the Bangladeshi government eventually settled on a new minimum wage amounting to 114 dollars, a move that was not met with support from governing bodies, and led to the US government calling for the reconsideration of the decision.

Authorities also looked to crack down on the supply of products that utilise forced labour, expanding import restrictions on companies that allegedly used such processes in an effort to eliminate related goods for the US supply chain. A total of 27 entities have been added to the Uyghur Forced Labour Prevention Act Entity List, each restricted due to their alleged involvement in practices concerning persecuted groups in labour camps in the Xinjiang region in China. Big brands like Adidas, Nike and Shein were also unveiled to be under investigation in the US for potential links to forced labour.

Skims secures eye-watering valuation

On a contrasting note, and in continuation of celebrity-backed fashion ventures, Kim Kardashian’s Skims was among those shooting for success this year. The shapewear and intimates brand secured a four billion dollars valuation after closing a sizable funding round led by Wellington Management. The news came as the label reported “incredible” year-on-year growth, seeing it on track to achieve 750 million dollars in net sales and bringing its total raised funding to 670 million dollars.

Kardashian also went about cementing a number of ‘firsts’ for the brand. 2023 marked the launch of Skims’ first European pop-up, the beginning of its permanent physical store venture, the establishment of a menswear line and new partnerships with national sports associations. The reality star’s level of success could not even be overshadowed by the launch of a new brand by one of her billionaire sisters, Kylie Jenner, who unveiled faux-leather label Khy in late October.

Adidas pivots towards US, launches Gen Z brand

Like Gap, Adidas was another to be financially hit by the impact of a gridlocked partnership with the controversial Kanye West. It also suffered from the termination of its collaboration with Beyoncé and her sportswear brand Ivy Park. While its decision to sell-off remaining Yeezy x Adidas stock reportedly raked in almost one billion dollars, leading to an improved outlook at the company, it became evident that such an initiative could not be relied on for the long-term. As such, Adidas executives said they would be ‘doubling down’ on the US sports market, detailing plans to secure more celebrity endorsements and singling out US-focused sports categories like Basketball.

Steps to aid in achieving such a feat could already be seen in the launch of a new Gen Z-centric brand, Adidas Sportswear, for which a campaign fronted by actress Jenna Ortega aimed to highlight its “sporty in essence” aesthetic. Similarly, the German brand made it known that it was to continue its efforts to cater to the swiftly growing football – or soccer – culture in the US, initiating several initiatives and investments into the sport as appreciation heightens in the region. These involved plastering imagery of Lionel Messi on billboards ahead of his entry into Major League Soccer, providing kits for the 2023 Women’s World Cup and pushing campaigns for the US Women’s National Team.

PVH embarks on streamlining strategy

While Adidas looked to secure wider favour with US audiences, PVH was attempting to keep a grasp on such favour in the region, while implementing a new streamlining strategy. The fashion conglomerate had previously said that it was planning to cut its workforce by 10 percent before the end of 2023, with its latest round of cuts bringing in severance expenses of around 50 million dollars. Meanwhile, at its leading brands, Calvin Klein and Tommy Hilfiger, attempts to secure profitability were made in the overhaul of leadership teams, with a number of executive appointments being made throughout the year including new brand presidents at both labels.