Paris – French luxury group Kering announced Thursday it will take a stake in Italian fashion house Valentino as it released results that underperformed rivals thanks to stagnating sales at Gucci.

The deal to acquire a 30 percent stake in Valentino from its owner Mayhoola opens the possibility of the Qatari investment fund becoming a shareholder in Kering even as the luxury group spoke about the need to invest in its fashion

houses.

The deal for the 30 percent stake for 1.7 billion euros (1.87 billion dollars) in cash, which is expected to close by the end of the year, also includes an option to completely buy the Italian fashion house through 2028.

“The transaction is part of a broader strategic partnership between Kering and Mayhoola, which could lead to Mayhoola becoming a shareholder in Kering,” the companies said in a joint statement.

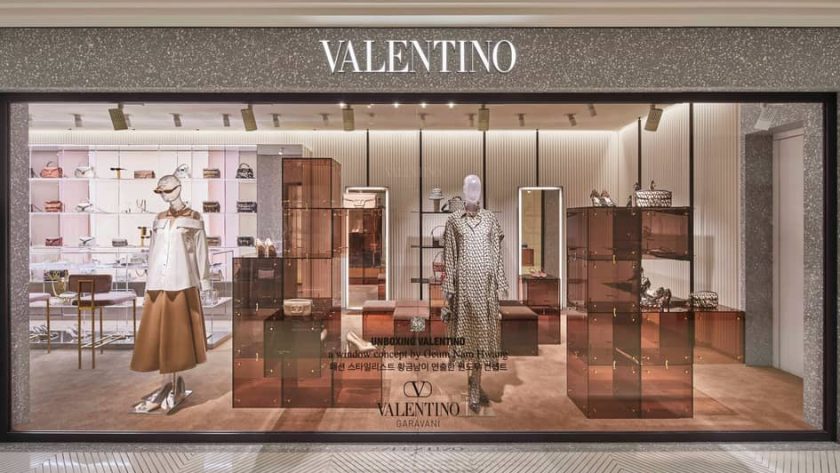

This strategic partnership “will further support the brand elevation strategy implemented by Valentino CEO Jacopo Venturini under the ownership of Mayhoola, which turned it into one of the most admired luxury houses in the world,” they added.

Meanwhile, Kering reported its net profits slid 10 percent in the first half of the year to 1.79 billion euros (1.97 billion dollars).

While overall revenue rose by two percent to 10.1 billion euros (11.1 billion dollars), they dipped by one percent at Gucci.

Earlier this month Kering announced a shake-up at Gucci, replacing the long-time chief executive with a confident of Kering chief executive and owner Francois-Henri Pinault.

Kering has underperformed its rivals in recent years as the luxury industry has seen phenomenal growth.

LVMH, the world’s top luxury group, on Tuesday posted a 15-percent increase in first-half sales while profits jumped by 30 percent.(AFP)