Luxury giant Kering has announced that it has completed the acquisition of a 30 percent shareholding in Valentino after receiving a green light from antitrust authorities.

The conglomerate had initially announced its intentions in July, stating at the time that it had entered into a binding agreement with investment equity firm Mayhoola for the 1.7 billion euro deal.

As part of the agreement, Kering was also presented with the option to acquire 100 percent of the share capital of Valentino no later than 2028, building on a broader strategic partner between the group and Mayhoola.

With the deal’s finalisation, Kering will become a significant shareholder of Valentino with board representation, while Mayhoola is to remain on as majority shareholder as it continues to execute the brand’s elevation strategy.

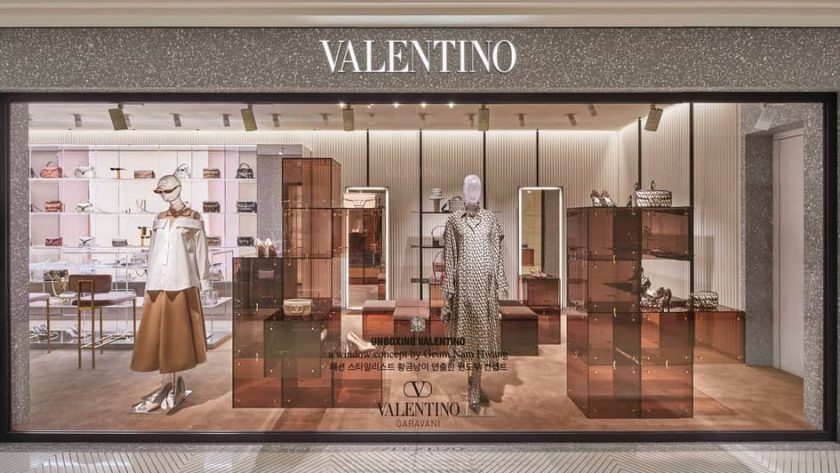

The scheme is currently being implemented by the Italian house’s chief executive officer Jacopo Venturini, and is understood to have strengthened the foundations of the ‘Maison de Couture’ ahead of its next step with Kering.